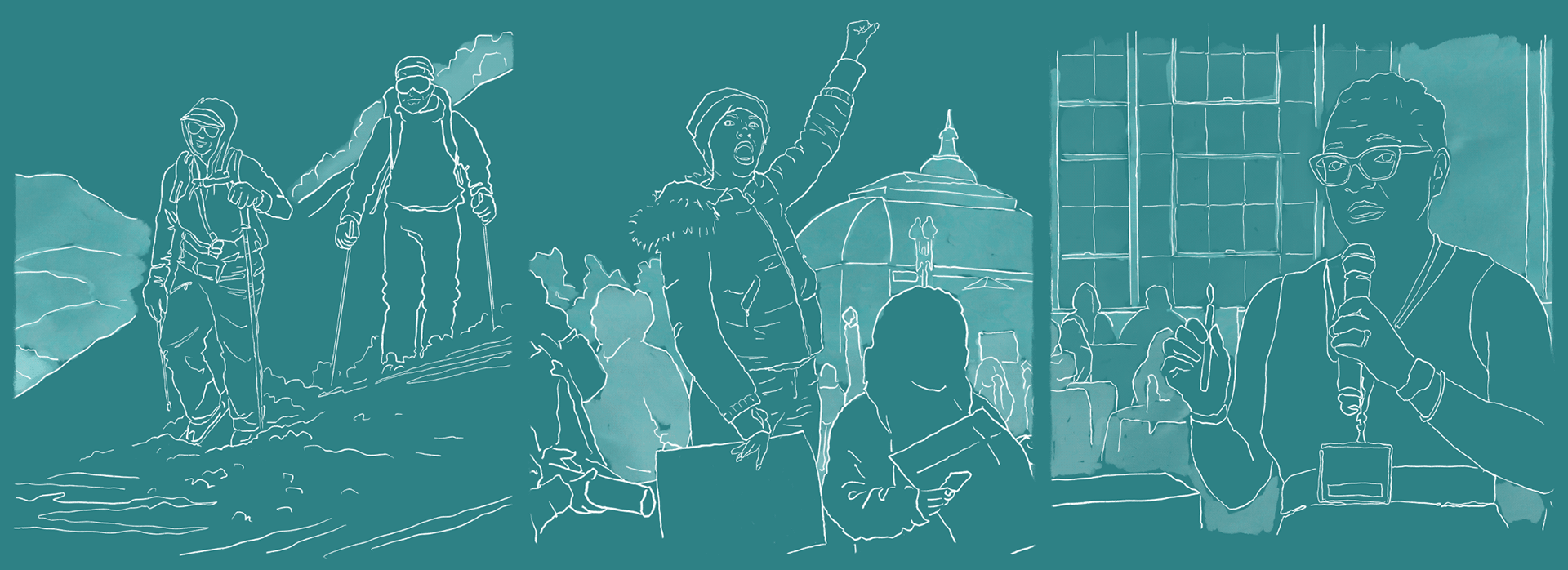

Explore Our Story

Mission

Building political and cultural power that centers racial and gender justice.

Money

Investing intentionally and redistributing wealth.

People

The remarkable individuals who shaped our foundation’s vision.

Perspectives

Reflections and insights evolving over the last five years of our work.

The End (start here)

An interactive story about the six best things we ever did.

Compton Foundation 1946–2025

Compton Foundation may be history but our people and our partners are still shaping the future. As we transition from active grantmaking to a historical archive, we hope these pages serve as both a record and an inspiration.